Digitalizing your procurement and finance processes is no longer a “nice to have”—it’s a strategic imperative that will define your competitiveness in the years ahead. But with so many software solutions on the market, how can you be sure you’re making the right choice? How do you avoid the pitfalls that can turn a promising project into a financial and organizational sinkhole?

This article breaks down the six essential criteria that should drive your decision. Each one can make—or break—your digital transformation journey.

1. Functional Coverage: The Backbone of Your Digital Solution

Before making any decision, assess whether the platform’s standard features meet your business needs. Can the solution handle all use cases identified during the scoping phase without custom development?

Also evaluate its native automation capabilities: Can it manage configurable approval workflows, parameterized controls rules, and fully automated Source-to-Pay processes?

Ideally, these capabilities should be built in. Otherwise, custom developments increase both costs and risks for implementation, maintenance, and future upgrades. Timelines often suffer too, delaying go-live by several weeks.

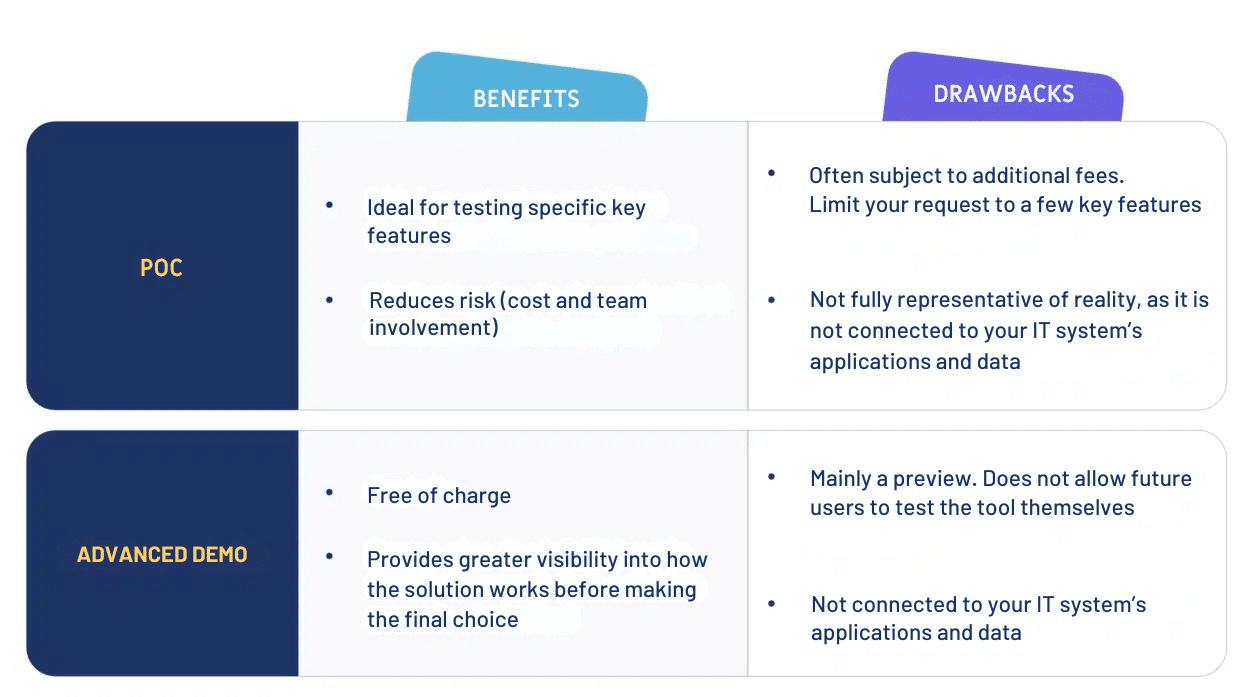

Should You Request a POC (Proof of Concept)?

A POC lets you test a key process under near-real conditions, typically during the pre-sales phase. It helps validate the software’s fit and reassures stakeholders.

If you’re simply comparing options, an advanced demo might be more relevant—it shows how specific features address your needs via concrete use cases.

Fluxym’s Advice

Integrate a real business case from the very beginning of the scoping phase. This approach consists of running one or several demonstrations based on processes that are specific to your organization. The benefits are threefold: you quickly validate how well the solution meets your functional needs, stakeholders can clearly visualize how it would work in real life (which makes adoption easier), and the process remains simple to set up.

2. User Experience: The Key to Sustainable Adoption

« Project ROI = Optimization Rate × Adoption Rate »

Vincent Lounaouci, COO of Fluxym

No matter how powerful the solution is, without user adoption it becomes an empty shell. Even the best change management won’t be enough if the tool isn’t user-friendly.

A seamless user experience enables both administrators and end users to work efficiently and autonomously. An intuitive interface reduces training needs, lowers support tickets, and boosts satisfaction from day one. Administrators should be able to configure workflows, manage roles, and generate dashboards without relying on external vendors.

In contrast, a rigid, complex UI leads to change resistance, support overload, productivity loss, and in the worst case, project abandonment. That’s why user experience must be a top priority, not an afterthought.

3. Integration into your Information System: The Hidded Driver of your Success

Your procurement and finance solution must integrate seamlessly into your IT ecosystem to enable smooth data flows and process automation.

Ensure the tool is interoperable with your ERP via prebuilt connectors, APIs, or web services. But technical compatibility isn’t enough: your implementation partner’s experience with your system is critical. Have they integrated this solution with your ERP or a similar setup before?

Prior experience reduces technical risks, accelerates timelines, and improves collaboration across teams.

One case in point : Radiall successfully integrated Basware into their ERP thanks to Fluxym’s support. Their experience highlights the importance of expertise during deployment.

Also consider if the software can adapt to your roadmap. A flexible platform allows rollouts by module, region, or business unit—minimizing disruption, reducing costs, and easing change management.

4. Scalability: Your Best Long-Term Guarantee

Your business is constantly evolving, whether through growth, mergers, acquisitions, or international expansion. Your finance/procurement software should evolve with it.

It must handle growing volumes of suppliers, transactions, and invoices without sacrificing performance or usability.

The platform should also support organizational changes (new entities, countries, or users) without requiring major reconfigurations. This scalability ensures lasting ROI and long-term viability.

5. Reputation & Innovation: Proofs of a Reliable Partner

Choosing a reliable and innovative software vendor ensures long-term peace of mind. But how can you make the right choice? Several key criteria should guide your evaluation.

Start by reviewing their roadmap: what major updates and developments are planned over the next 12 to 24 months? A clear vision of the technologies in use or being deployed (AI agents, blockchain, etc.) is a strong indicator of their long-term innovation capacity.

Next, look into the vendor’s reputation. You can rely on reports from leading market analysts (Gartner, Forrester, Ardent Partners, etc.). These studies provide an objective view of each solution’s competitive positioning, as well as its strengths and weaknesses.

Complement this research by analyzing the vendor’s customer references: are they similar to your organization in terms of size, industry, ERP environment, etc.?

You can also request direct references. Nothing beats a real-life testimonial. Ask your peers about any challenges they faced, whether timelines and budgets were met, the quality of post-deployment support, and overall satisfaction.

Finally, don’t overlook the presence of a user group. It’s often a sign of a vendor committed to continuous improvement and close collaboration with its clients. These communities are fertile ground for peer-to-peer exchange and often where the most relevant innovations emerge.

6. Legal Compliance & Cybersecurity: Must-Haves, Not Options

Often decisive in the final choice, compliance and security must not be overlooked.

Ensure the tool complies with current and upcoming regulations. You should be able to generate audit trails, access documentation, and produce compliance reports easily.

Also verify key security features: MFA, encryption, fraud detection, and prevention. Ask who manages infrastructure, backups, and monitoring, and what your responsibilities are for user access and policies.

Responsibilities should be clearly defined, with contractual SLAs and legal safeguards in place.

You now have the essential information to assess, compare, and select the software best suited to your organization.

But choosing the right platform isn’t enough. Successful digital transformation requires careful planning, strong change management, and the right implementation partner.

To maximize your success, download our Ebook, resulting from 20+ years of experience and 500+ successful projects. Inside, you’ll find:

- Client and expert insights on successful digital transformations

- A visual checklist of the criteria outlined in this article

- A side-by-side comparison of software vendors vs. integrators

- The 6 critical mistakes to avoid during preparation